The Impact of DeFi Trading Bot on Boosting Liquidity in Crypto Exchanges

Liquidity is essential to the smooth functioning of cryptocurrency exchanges in decentralized finance (DeFi). Liquidity is the power to execute trades quickly with minimal influence on prices. DeFi trading bot, which carry out trading strategies on decentralized platforms are at the forefront of improving liquidity. These highly developed instruments called DeFi trading bots or DeFi bots use advanced algorithms to maximize market participation, They take advantage of arbitrage opportunities and improve market-making operations. This blog studies the new ways that DeFi trading bot improves liquidity on cryptocurrency exchanges and their tremendous impact on the changing DeFi market.

What Is Liquidity in DeFi Exchanges?

Liquidity on DeFi exchanges is characterized by the powerful availability of assets that can be swiftly traded without exerting a significant impact on their market prices. Because of this liquidity, traders may complete transactions quickly and easily by reducing slippage and preserving competitive and equitable market conditions. DeFi’s depth of liquidity makes it easier to find prices and enables a wide variety of trading techniques which improves market accessibility and stability for everyone looking for fast execution and the best possible trade results.

DeFi Bot – What Is It?

DeFi bot also known as Decentralized Finance bot is an automated software program designed to execute trading strategies on decentralized platforms. These bots utilize predefined algorithms and market data to analyze trends, place orders and manage portfolios in real-time. By automating trading activities, DeFi trading bot enables traders to capitalize on market opportunities 24/7 without the limitations of manual trading.

How the DeFi Trading Bot Increases Liquidity

DeFi trading bot greatly enhances liquidity on crypto exchanges through several mechanisms:

- Continuous Market Participation: Unlike human traders, DeFi bot operates non-stop and ensures continuous market participation. This constant activity helps maintain liquidity by providing consistent buy and sell orders across different assets.

- Arbitrage Opportunities: DeFi bot takes advantage of price differences between several trading pairs or exchanges, It makes trades instantly to profit from arbitrage opportunities. This procedure raises overall market efficiency and aids in price parity.

- Market Making: Many DeFi bots act as market makers by placing limited orders on both sides of the order book. By offering competitive prices and supplying market liquidity, these bots create a smoother trading experience for users.

- Reduced Spread: DeFi bot actively contributes to reducing bid-ask spreads by providing liquidity at various price levels. A narrower spread promotes increased trading activity and improves market efficiency, benefiting all participants.

- Support for New Token Listings: DeFi bot often supports new token listings by providing initial liquidity. This proactive participation encourages early trading activities, boosts token adoption and expands liquidity pools for emerging assets.

Benefits of DeFi Bot Development for Crypto Exchanges

The development of DeFi trading bot offers numerous benefits to crypto exchanges seeking to enhance liquidity and attract more traders:

- Increased Trading Volume: By boosting liquidity, DeFi bot attracts more traders to the platform, leading to higher trading volumes and increased transaction fees.

- Improved Market Efficiency: Automated trading reduces latency and enhances the speed of order execution, improving market efficiency and reducing price discrepancies.

- Risk Management: Advanced algorithms integrated into DeFi bot can implement risk management strategies such as stop-loss orders and portfolio diversification to minimize the potential of losses for traders.

- 24/7 Trading: DeFi trading bot operates continuously, by enabling round-the-clock trading activities without human intervention, thereby capitalizing on global market opportunities and accommodating diverse time zones.

- Scalability: As trading volumes grow, DeFi bot can scale operations seamlessly. Also handling increased transaction loads, maintaining liquidity across multiple trading pairs and markets.

- Data-Driven Insights: DeFi trading bot utilizes real-time market data and analytics to inform trading decisions, by enabling adaptive strategies that respond swiftly to market variations and emerging trends.

- Enhanced User Experience: By providing faster and more reliable trade executions, DeFi bot enhances the overall user experience for attracting and retaining traders who value efficiency and responsiveness in trading platforms.

How to Integrate DeFi Trading Bot into a Crypto Exchange Platform?

Integrating DeFi trading bot into a crypto exchange platform involves several steps:

- Platform Compatibility: Ensure that the trading bot is compatible with the exchange’s API and infrastructure.

- Algorithm Development: Develop or customize trading algorithms tailored to the exchange’s trading pairs and user preferences.

- Testing and Deployment: Before deploying the bot, thoroughly test its performance in both simulated and live trading environments to ensure reliability and efficiency.

- Monitoring and Optimization: Continuously monitor the bot’s performance and optimize trading strategies based on market conditions and user feedback.

- Regulatory Compliance: Navigate regulatory requirements and compliance standards relevant to automated trading activities. Ensure that the bot adheres to applicable legal frameworks and operational guidelines to reduce regulatory risks and facilitate faith among users and stakeholders.

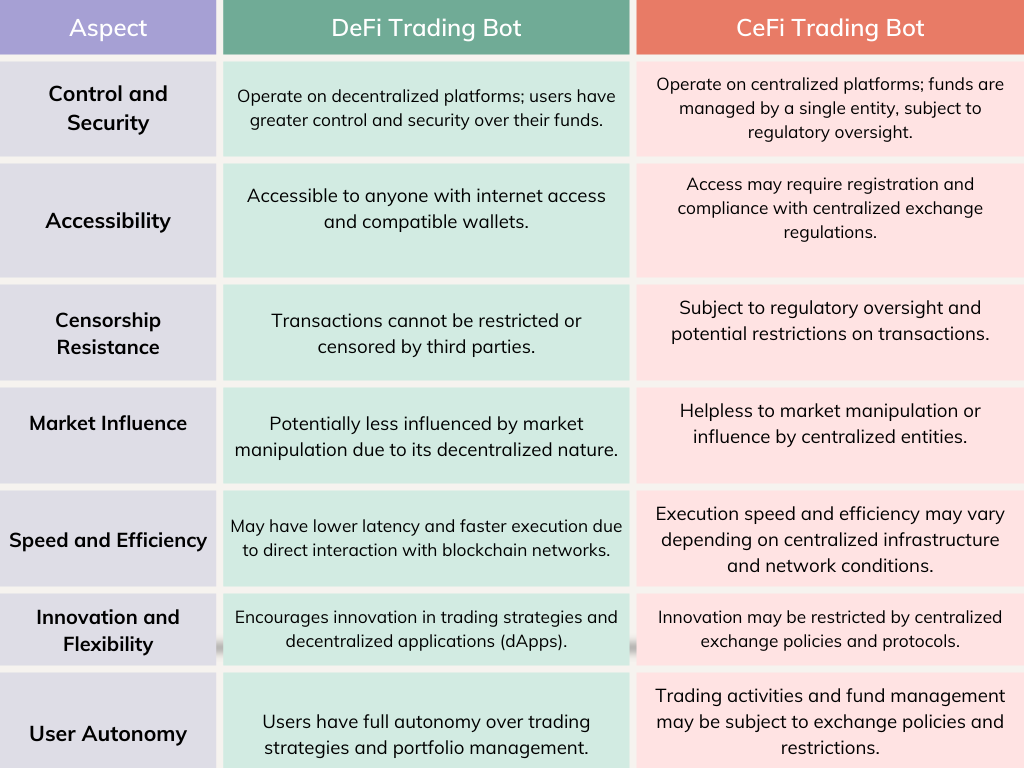

What Are the Differences Between DeFi and CeFi Trading Bots?

Conclusion

DeFi trading bot is a game-changing automated program that dramatically increases the market liquidity on cryptocurrency exchanges, by opening the door to more accessible and effective financial markets. Through the automation of trading operations, risk mitigation and market participation optimization, these bots greatly contribute to the development of decentralized finance in the future. Exchanges hoping to remain competitive and draw in more traders will need to incorporate advanced trading techniques and technologies as the DeFi ecosystem develops.

Crypto exchanges should capitalize on fresh chances for expansion, creativity, and market liquidity, by adopting DeFi trading bot development, which will ultimately promote a stronger and more resilient financial ecosystem.

Why Choose Us?

Choose Kryptobees for skillfully customized DeFi trading bot development that optimizes liquidity and enhances trading efficiency, With a proven track record in crypto trading bot development. Kryptobees offers premium solutions that integrate seamlessly with your platform. Our innovative approach ensures security, compliance and scalable performance that is supported by transparent communication and dedicated client service. Trust Kryptobees to drive your DeFi trading strategy forward.

Discuss Project!

Discuss Project!