Implementing Triangular Arbitrage Bot: A Risk-Free Trading Strategy to Maximize Profit

In cryptocurrency and forex trading, the search for profitable strategies is endless. One such strategy that has gained significant attention is triangular arbitrage. Triangle Arbitrage Bot involves taking advantage of pricing differences between three currency pairings.

This method has been around for a long time, and the introduction of automated trading bots has made it more accessible and efficient than before. In this blog post, we’ll look into triangular arbitrage bot and how to use a bot to automate this trading method efficiently.

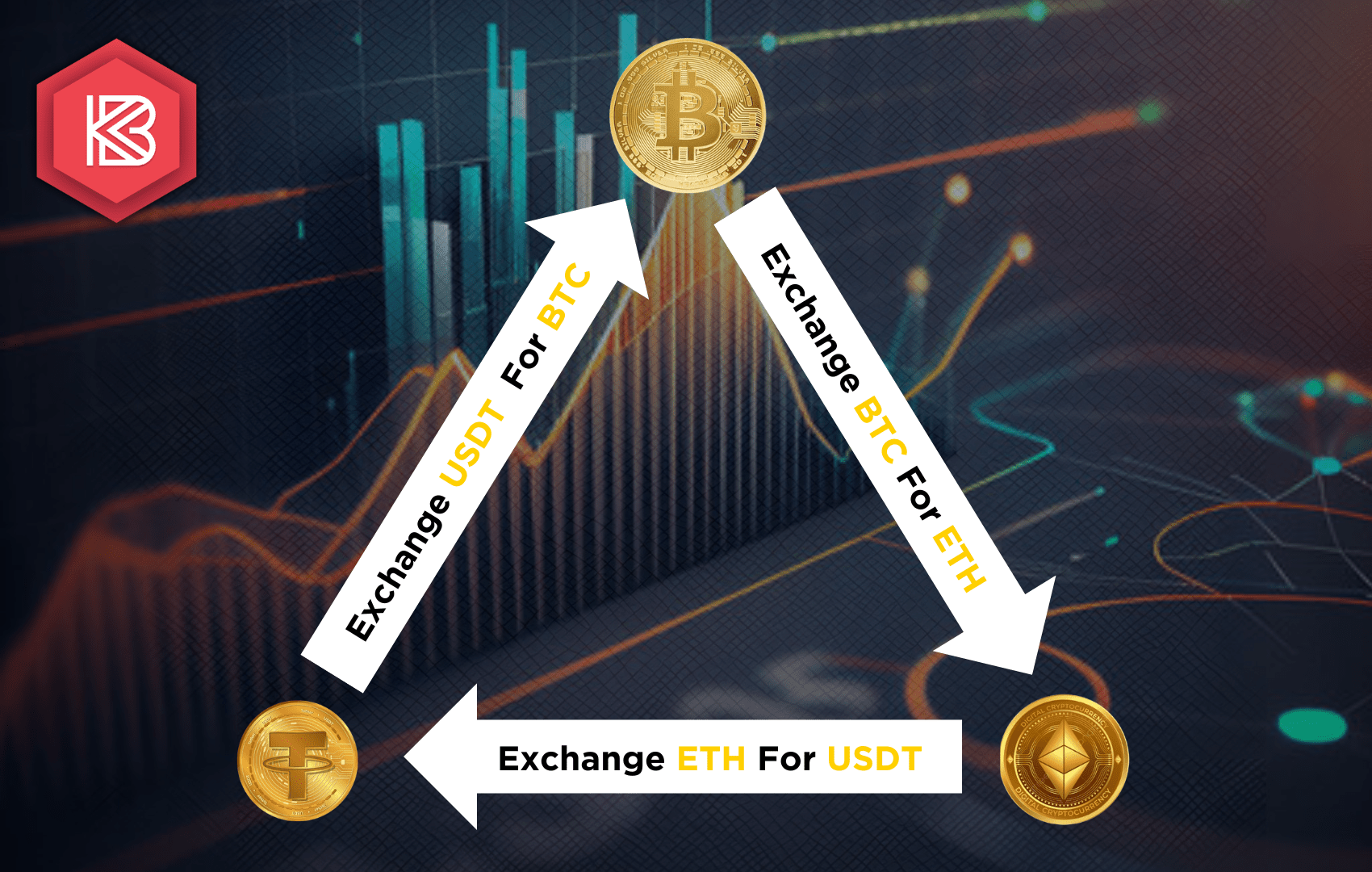

What is Triangular Arbitrage?

Before going into the implementation of a triangle arbitrage bot, it’s important to understand the concept of triangular arbitrage. In its most basic form, triangle arbitrage entails taking advantage of pricing differences between three currency pairings. For example, if the exchange rates for USDT/EUR, EUR/GBP, and GBP/USDT do not completely align, there is a potential to benefit by executing a series of trades that take advantage of the differences.

Challenges in Manual Execution

While triangular arbitrage presents a profitable opportunity, executing it manually poses several challenges. Firstly, identifying suitable arbitrage opportunities requires constant monitoring of multiple currency pairs, which can be difficult for human traders. Additionally, manual execution is susceptible to delays, resulting in missed opportunities or insufficient trades. Moreover, the margin for error is higher when dependent just on human judgment, increasing the risk of losses.

Introducing the Triangular Arbitrage Bot

To overcome the limitations of manual execution, many traders have turned to automated solutions like the Triangle Arbitrage Bot. These bot are programmed to scan the market for arbitrage opportunities in real-time and execute trades with lightning speed and precision. By using algorithms and powerful mathematical models, these bots can find and execute arbitrage possibilities more efficiently than human traders.

How Does A Triangular Arbitrage Crypto Bot Work?

A Triangular Arbitrage Bot works by constantly monitoring currency pairs across exchanges to identify opportunities where price differences exist. It uses established algorithms to evaluate associated risks and compute potential returns. When a viable opportunity is identified, the bot quickly executes trades across the three currency pairs (USDT/EUR, EUR/GBP, and GBP/USDT) involved in the arbitrage loop, locking in profits with each transaction. It thoroughly monitors order flow to reduce errors and improve efficiency. Finally, the bot calculates overall profits, taking into account transaction fees and spread expenses, and generates thorough reports for traders to review and optimize their tactics.

Benefits of Using the Crypto Triangular Arbitrage Bot

- Efficiency and Speed: Triangular arbitrage bot are lightning fast, scanning many currency pairs concurrently and completing trades in milliseconds. This quick response time ensures that profitable trades go looking or are explored, maximizing profit potential in a trading market.

- 24/7 Operation: Triangular arbitrage bot can work around the time, always scanning the market for new possibilities. This 24/7 availability allows traders to take advantage of arbitrage chances at any time, lowering the risk of lost opportunities and ensuring ongoing profit generation.

- Elimination of Emotions: By automating the trading process, triangle arbitrage bot eliminate the influence of emotions like fear, greed, and indecision. This emotional separation encourages a disciplined approach to trading, which results in more consistent and profitable outcomes over time.

- Precision and Accuracy: The triangular arbitrage bot executes deals with mathematical certainty using established parameters and algorithms. This guarantees that deals are made at the best time to maximize profit potential, giving traders a competitive advantage in the market.

- Minimized Workload: Triangular arbitrage bot undertake the heavy lifting of market analysis and trade execution, saving traders time-consuming manual activities. This allows traders to focus on strategy creation and optimization, resulting in better use of time and resources.

Risk Management and Considerations

- Volatility Mastery: Triangular arbitrage bot expertly handle unreliable markets, seizing opportunities and minimizing dangers. Their powerful algorithms find and capitalize on arbitrage opportunities even during market downturns, ensuring traders’ consistent performance and profitability.

- Reliable Execution: Triangular arbitrage bot conducts deals quickly and accurately. Traders can count on their bot to execute perfectly, allowing them to focus on strategy-building with confidence.

- Liquidity Confidence: Using triangle arbitrage bot, traders may confidently analyze liquidity across exchanges and trading pairings. This feature allows traders to enter and exit positions easily, improving trade execution for optimum profit.

- Slippage Control: Triangular arbitrage bot effectively manages slippage by performing trades precisely to optimize profits. Their innovative algorithms reduce market effects, assuring the best possible outcomes for traders.

- Compliance Assurance: Triangular arbitrage bot follow regulatory guidelines, protecting traders from legal dangers. Traders can trade with confidence since they know their bot is operating legally, allowing them to focus on maximizing profits.

Final Thoughts of Triangular Arbitrage Bot Development

Accepting the use of a triangle arbitrage bot offers a promising path for traders looking for profitable opportunities in the cryptocurrency and forex markets. Traders can use automation and advanced algorithms to leverage the power of price differences across currency pairings with new precision and efficiency. However, it is essential to approach automated trading with confidence, establishing strong risk management measures to minimize potential losses. With the correct approach and advanced technology, the triangle arbitrage bot stands as an indicator of opportunity. Ready to elevate trade performance and bring in a fresh period of steady prosperity.

Why Should You Pair Up With Kryptobees To Develop A Triangular Arbitrage Bot?

At Kryptobees, we have a team of expert developers who have previously built multiple successful crypto arbitrage trading bot. Using our extensive domain knowledge, we specialize in providing customized triangle arbitrage bot creation services that are suited to our clients’ specific needs. Whether you want to easily integrate our triangular arbitrage bot into your current crypto exchange platform or launch a new exchange with advanced trading capabilities, we are ready to exceed your expectations and deliver optimal results for your enterprise.

Discuss Project!

Discuss Project!