Launch Your Own Neobank Mobile App With Kryptobees

Neobank app development is experiencing remarkable growth in 2023, revolutionizing the digital banking and financial industry. Neobanks are digital banking platforms that operate exclusively through mobile apps, offering a range of innovative and user-friendly financial services. These apps provide customers with convenient access to their accounts, seamless transactions, and personalized crypto banking experiences.

The development of neobank apps in 2023 is flourishing due to the increasing demand for digital banking solutions. Customers are seeking more efficient and flexible banking options that align with their modern lifestyles. Neobanks meet these demands by offering individualized Neo banking services and proposals by utilizing cutting-edge technology like artificial intelligence/machine learning.

What does Neobank actually mean?

Neobanks are innovative digital banking platforms that operate entirely in the digital realm, diverging from the traditional brick-and-mortar banking model. These banks are typically managed by fintech companies and function without physical branches. Despite lacking official licenses, they boast a substantial user base.

Neobanks deliver their services through user-friendly mobile applications, which can be easily installed and utilized by customers. Understanding the concept of Neobanks is crucial for developing a Neobank app. The Neobank business model primarily caters to users seeking straightforward cash management solutions. The key focus lies in leveraging advanced technology to handle extensive data volumes and granting access to Neobanking solutions to a broad spectrum of users.

The workflow process of the Neobank application

The workflow process of a neobank application involves several key steps. Here is a step-by-step overview of the process:

Define the neobank’s target market and objectives:

Identify your target customer segment and set neobank objectives like convenient services, financial inclusion, or innovative solutions.

Conduct market research and feasibility analysis:

To create a neobank, gather information about the competitors, regulations, and customer needs. Assess the feasibility, potential demand, and profitability of your neobank concept.

Formulate a business plan:

Develop a comprehensive plan outlining your neobank’s value proposition, revenue sources, costs, marketing strategies, and financial projections. This will guide the neobank through its development and operations.

Establish strategic partnerships:

Collaborate with established banks, fintech companies, or tech providers to leverage their expertise, infrastructure, and regulatory compliance. Partnerships can fast-track development and provide access to essential banking services

Obtain licenses and regulatory approvals:

Comply with banking regulations and acquire necessary licenses from relevant authorities.

Develop back-end infrastructure:

Build a core neobank platform using banking-as-a-service providers or existing platforms to reduce costs.

Create customer-facing mobile app:

Develop a user-friendly app with essential features and focus on seamless user experience across devices.

Implement security measures:

Prioritize customer data security with encryption, authentication, and fraud detection systems.

Integrate with external services:

Connect with payment processors and other service providers for seamless transactions and additional services.

Perform testing and quality assurance:

Conduct rigorous testing to identify and resolve any issues related to functionality, performance, compatibility, and security.

Launch and deploy the neobank:

Deploy the application and monitor the system closely during the initial stages to ensure stability.

Continuously improve:

Gather customer feedback and analyze data to enhance features, user experience, and customer support based on market trends.

The Process of a Neobank app development

Our clients frequently inquire about the process of building a neobank from the ground up. They seek information on the financial investment, time commitment, project structure, initial steps, and strategies for successful and profitable outcomes.

Discovering the requirement Phase

Every project begins with an idea. By understanding the objectives of the future neobank service, we initiate an analytics gathering process. This involves conducting an in-depth market analysis, examining existing solutions, studying competitors, and analyzing customer behavior patterns. Throughout this analysis, we prioritize the end-user and meticulously design the customer’s life cycle. Our goal is to create a user-friendly, comprehensible, and valuable Neobank mobile app that not only benefits the users but also contributes to the success of your business.

Designing phase

We meticulously outline the functionality and design of the upcoming application. Defining user personas, crafting the User Story, creating a Customer Journey Map, and establishing technical requirements ensure a clear vision of the desired application. This technical assignment enables our team of designers and developers to understand the customer’s service expectations and progressively bring the initial idea to life.

Developmental and Bug Testing phase

Once the technical specifications and prototypes are approved by the customer, the active development phase commences. For more intricate projects, it is advisable to adopt an MVP (minimum viable product) approach, implementing the essential functionalities to evaluate the application and plan for future development. Following development, rigorous testing on mobile devices ensures to identify and rectify any imperfections or issues, ensuring the application is polished and ready for a comprehensive release.

Entrepreneurs in the neobanking sector can benefit from following these steps, which provide guidance and ensure a more profitable mobile application development process.

Step 1: Pick your targeted audience and Value Proposition

Prior to commencing app development, thorough research is essential to identify the target audience and establish a compelling value proposition. Neobanks, aiming to disrupt traditional banking, must have a clear understanding of the niche they intend to target and the value they can bring. Market research, including competitor analysis, provides valuable insights into the competitive landscape.

This analysis empowers developers to make informed decisions, plan strategically, and devise effective strategies. By delving deep into the market, developers gain insights into untapped and potentially lucrative segments such as investors or travelers, leading to favorable outcomes. Additionally, studying competition offers valuable insights on customer preferences and guides the development of a successful Neobank app.

Step 2: Establish the basic foundation for a Neobank

After gaining a thorough understanding of the target audience and competition, it is crucial to identify the key features that address the specific challenges faced by the audience. These features form the foundation of the Neobank application, which should be agile, customer-centric, and innovative. Incorporating unique and essential features not only ensures customer retention but also attracts new users.

-

Cost-effective structure

-

Seamless cross-border cash flow

-

Efficient account creation

-

User-friendly interface

-

Real-time solutions

-

Profitable investments alongside effective financial management

-

Personalized physical or virtual card issuance

-

Additional features

-

No joining, annual, or documentation fees

-

Transparent pricing without hidden charges

-

No-cost EMI options

-

Personalized banking services

-

Education or loan investment options

-

Budgeting tools

-

Customized rewards to cater to individual user needs

Neobank apps need to develop a monetization strategy and identify core and additional revenue sources. Determining target launch markets and selecting suitable platforms like Android and iOS (based on audience and features) are crucial decisions. Thorough pre-development information gathering helps avoid future complications.

Step 3: Establish Firm Foundations: Frontend Development and Backend Infrastructure

For Neobanking applications, having a robust infrastructure is crucial. Both frontend and backend development should be powerful to ensure fast and smooth transactions without any lags or crashes, delivering a seamless user experience.

Key components of a well-built Neobanking app include:

-

Application Programming Interface (API): Connects Neobanks with payment gateways and authentication systems.

-

Card Processing Apps: Enable seamless transactions using cards.

-

Back-office tools: Manage overall Neobank operations.

In addition to a strong backend, the front-end design should be visually appealing and user-centric, catering to app orientation. Smooth animations and captivating color schemes engage users, encouraging longer app interactions. Empathizing with user requirements is essential for a successful Neobank application.

Step 4: Continue Neobank compliant and protected

To gain user trust and ensure a secure environment, Neobank apps must prioritize regulatory compliance and robust security measures. Implementing standards like PCI DSS Compliance, tokenization, and payment token generation safeguards customers’ personal and financial data. Establishing a Security Office Center is crucial for maintaining compliance and security regulations. Bots can efficiently detect anomalies, operate round the clock, and perform tasks consistently without fatigue or errors, enhancing the overall security infrastructure of the Neobank application.

Step 5: Testing

Prior to launching the application on various platforms, it is essential to conduct comprehensive testing and debugging. This process ensures the identification and resolution of any issues that may impact the app’s performance and functionality. Various types of testing, such as unit testing, integration testing, security testing, user acceptance testing, and regression testing, should be conducted not only before app launch but also continuously after it goes live.

Step 6: Deployment

After launching the app, developers must prioritize a user-friendly onboarding process and continuously improve the application based on customer feedback. Regular updates and deploying new versions are made seamless with tools like DevOps, enabling scalability and efficiency. By eliminating previous instances and handling heavy traffic, the app can evolve into an optimal version for users.

Step 7: Marketing

Effective marketing efforts are essential for attracting and retaining customers in the neobank industry. Maintaining customer engagement throughout their journey encourages repeat usage. A favorable long-term value of clients compared to the consumer acquisition expense ratio, which implies more income for every client, must exist in order for a neobank to be sustainable. Therefore, prioritizing customer satisfaction is crucial for long-term success.

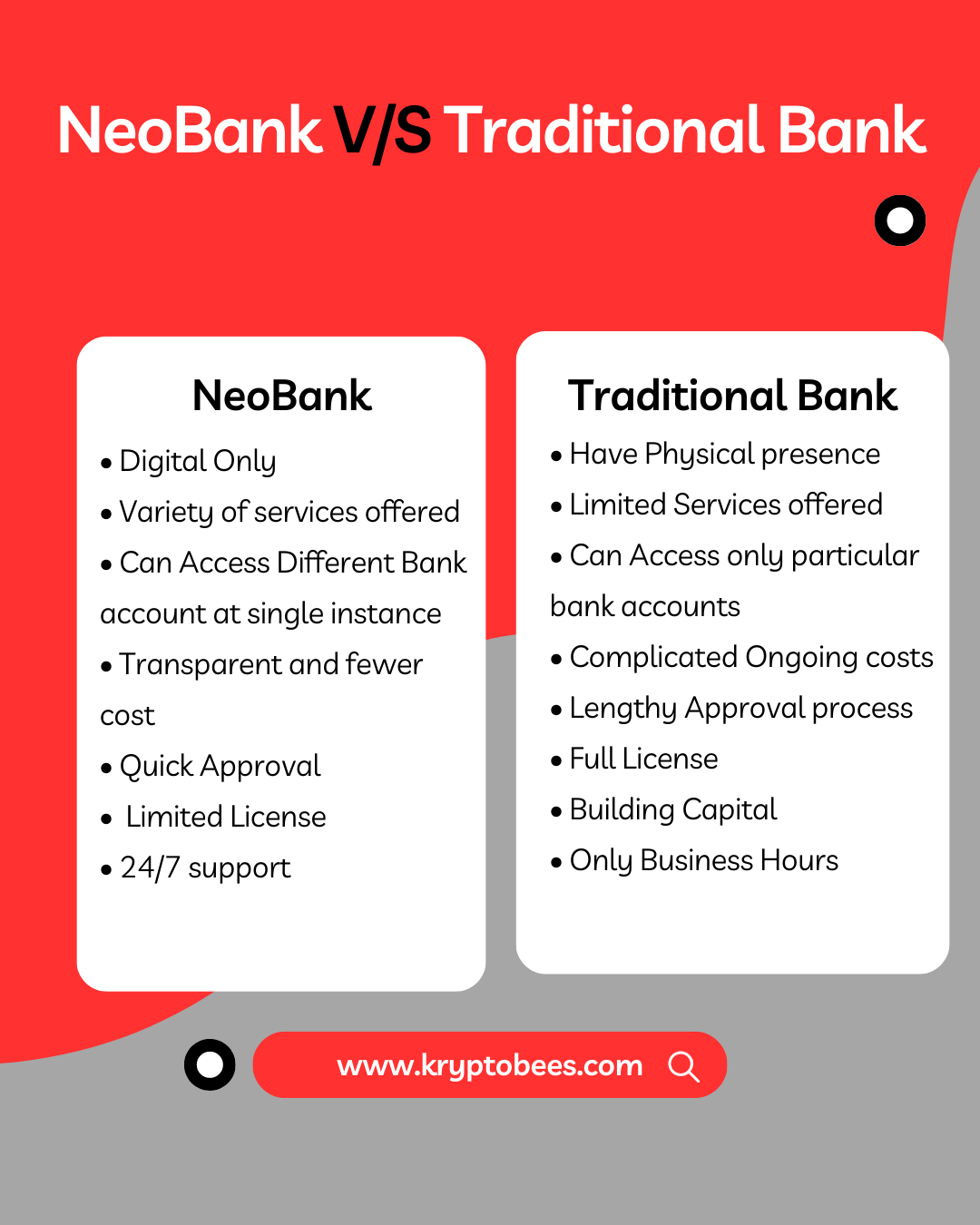

Difference Between Traditional Bank and Neobank

Features of Neobanking Mobile Application

Certainly! Here is a list of features commonly found in neobanking mobile applications:

1. Account Opening

2. Personalized Dashboard

3. Funds Transfer

4. Card Management

5. Savings and Budgeting Tools

6. Customer Support

7. Cardless ATM Withdrawals

8. Currency Exchange

9. Financial Insights and Analytics

10.Integration with Third-Party Services

The cost required for the development of the Neobank Mobile App?

The cost to build a neobank app in 2023 can vary greatly based on numerous factors, such as the scope, complexity, features, and development approach. Here’s a breakdown of the main components that influence the cost:

App design:

A visually appealing and user-friendly app design is crucial. The cost can range from $5,000 to $20,000, depending on the level of detail and customizations.

Backend platform development:

Building the core banking platform can cost anywhere from $20,000 to $100,000+, depending on the technology used, complexity, and integration with external systems.

Mobile app development:

Developing the app for iOS and Android can range from $10,000 to $50,000 per platform, depending on features, complexity, and whether using native or cross-platform development.

Integration with external services:

Integrating payment processors and other third-party services can range from $5,000 to $20,000.

Security and compliance:

Implementing security measures, encryption, and other compliance requirements can add $5,000 to $15,000+ to the cost.

Testing and quality assurance:

Ensuring the app works seamlessly across devices and scenarios can cost $3,000 to $10,000+.

Continuous support and updates:

Ongoing maintenance and feature enhancements can add an additional 15% to 20% of the initial development costs annually.

Considering these factors, the overall cost to build a neobank app in 2023 can range from $70,000 to $200,000+ for a basic to moderately complex app. Keep in mind that these estimates can vary depending on your location, development team, and specific requirements.

Get Estimation of our Neobanking mobile app solutions

Create your own Neobank from scratch With kryptobees

Armed with the necessary knowledge, entrepreneurs can now establish a thriving Neobank business. These innovative applications target the shortcomings of traditional banking systems and strive to enhance the overall banking experience.

Neobanks represent a promising trend in the global financial system, gradually expanding their presence alongside traditional banks. While complete replacement is unlikely, the neobank sector will continue to grow stronger, leading to a potential hybridization of neo and classic banking in the coming years. Traditional banks may embrace digital advancements and explore mergers and acquisitions with non-banks to stay competitive. As an experienced software development team in the crypto industry, Kryptobees can assist in bringing these projects to fruition, ensuring successful implementation within reasonable timeframes and budgets.

Discuss Project!

Discuss Project!